Connect with us

Connect with us

Aug 03, 2024

Aug 03, 2024

KEY HIGHLIGHTS

The Union Budget 2024-25 of India, aptly themed as the "Roadmap for our pursuit of 'Viksit Bharat'," sets the stage for sustainable economic growth and inclusive development. This comprehensive budget outlines significant investments and policy reforms across various sectors to impel India towards becoming a developed nation by 2047.

Shared below are the Key Highlights:

1. Infrastructure Development:

• An unprecedented allocation of INR 11 lakh crore is dedicated to infrastructure development, focusing on urban and rural projects. This includes the transit oriented development of 14 cities, enhancing connectivity and attracting substantial private investments .

• The budget has also emphasizes the development of new industrial parks and ecosystem enablers for manufacturing, promoting urban-industry synergies to boost economic growth.

2. Corporate Tax Rate:

The corporate tax rate for foreign companies has been reduced from 40% to 35%, making India a more attractive destination for foreign direct investment (FDI) and aligning the tax rate closer to that of domestic companies

3. Capital Gains Tax:

Long-Term Capital Gains (LTCG): The tax rate on long term capital gains for all financial and non-financial assets has been increased from 10% to 12.5%. Additionally, the benefit of indexation has been removed, which means taxpayers can no longer adjust the purchase price of assets for inflation, potentially increasing the tax burden on the sale of long-held assets.

Short-Term Capital Gains: Short-term capital gains on certain financial assets will now attract a tax rate of 20%, aligning it with the tax rate for ordinary income in higher brackets.

4. Angel Tax: The angel tax, which was imposed on investments in start-ups at valuations exceeding the fair market value, has been abolished.

5. Individual Salaried Class: For those opting for the new tax regime, the standard deduction has been increased from 50,000 to 75,000.

6. Support for MSMEs and Start-ups: The government has announced various measures to support Micro, Small, and Medium Enterprises (MSMEs). This includes a credit guarantee scheme and the establishment of ecommerce export hubs to boost demand and facilitate growth in this sector.

7. Job Creation and Education: To tackle unemployment and enhance the workforce, the budget includes initiatives such as providing one month's salary to new workforce entrants and offering loans of up to INR 10 lakh for higher education.

8. Focus on Sustainability and Climate Resilience: The budget emphasizes climate resilience with initiatives like the PM Surya Ghar Muft Bijli Yojana, which aims to install rooftop solar panels on 1 crore homes, providing free electricity up to 300 units per month.

9. Agricultural Sector: The government has allocated INR 1.52 lakh crore for agriculture, focusing on climateresilient practices, boosting productivity, and enhancing marketing efficiency. Initiatives include the development of agricultural clusters and promoting exports of shrimp and other produce.

10. Industrial and Manufacturing Sector: The budget emphasizes the development of new industrial parks and special economic zones. There is a push for domestic manufacturing through changes in customs duties and incentives for new manufacturing units.

CORPORATE NEWS JULY 2024

PERSONS IN NEWS

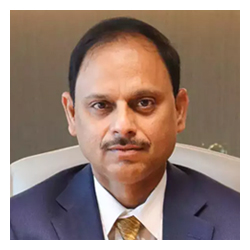

Mr. Naveen Chandra Jha appointed as MD & CEO of SBI General Insurance

SBI General Insurance Company has appointed Mr. Naveen Chandra Jha as its new Managing Director and Chief Executive Officer. Mr. Jha has been with the State Bank of India (SBI) since 1994, holding several key positions over his career. Before his current role at SBI General Insurance, he served as the Chief General Manager of the Amaravati Circle in Andhra Pradesh. With over three decades of experience in the banking sector, Mr. Jha has excelled in various functional and operational roles, including Branch Management, Credit and Risk Management (focusing on SME Credit), HR & Administration, and Retail Banking. His significant roles have included Regional Manager, Deputy General Manager (CDS), Deputy General Manager (Cadre Management), General Manager of Network, and Chief General Manager of the Circle.

Mr. KV Subramanian appointed as MD & CEO of Federal Bank

The Reserve Bank of India (RBI) has approved the appointment of Mr. Krishnan Venkat Subramanian as the Managing Director & Chief Executive Officer of Federal Bank. His three-year term will begin on September 23, 2024, following the conclusion of the tenure of the current MD & CEO, Mr. Shyam Srinivasan, on September 22, 2024. Mr. Subramanian brings a wealth of experience to his new role, having previously served as the Joint Managing Director of Kotak Mahindra Bank Limited until April 30, 2024. In his tenure at Kotak Mahindra, he led various critical divisions, including Corporate Banking, Commercial Banking, Private Banking, and Asset Reconstruction. He holds a degree in Electrical Engineering from the Indian Institute of Technology (IIT) - Varanasi, and a Post Graduate degree in Financial Management from Jamnalal Bajaj Institute of Management Studies, Mumbai.

ECONOMY

ADB, IMF, and FICCI project robust 7% GDP Growth for India in Fiscal Year 2024-25

The Asian Development Bank (ADB), the International Monetary Fund (IMF), and the Federation of Indian Chambers of Commerce & Industry (FICCI) have all projected a robust 7% GDP growth for India in the fiscal year 2024-25. This optimistic outlook, highlighted in a survey conducted in July 2024, reflects confidence among participating economists regarding the country's economic prospects, despite caution being advised due to global headwinds and inflationary pressures.

The survey forecasts an annual median GDP growth of 7% for 2024-25. Additionally, the Reserve Bank of India (RBI) has also revised its GDP growth projection upwards to 7.2% for this fiscal year. For the first and second quarters of 2024-25, median GDP growth is estimated at 6.8% and 7.2%, respectively. This consensus among major financial institutions underscores a positive economic trajectory for India amidst challenging global economic conditions.

ESG

Google and DHL Sign Deal to use Sustainable Aviation Fuel for Global Shipping

Google and DHL have entered into a partnership to enhance sustainable global shipping practices, aiming to reduce emissions significantly. This collaboration builds on a pilot project involving Sustainable Aviation Fuel (SAF) conducted last year and includes express shipping of Google devices. This initiative is part of Google's broader strategy to promote decarbonisation technologies in air transportation.

As part of this agreement, Google will utilize DHL's GoGreen Plus service for all future operations. GoGreen Plus leverages SAF to help customers reduce the CO2e emissions associated with their shipments. The service is backed by substantial industry contracts with major fuel providers BP, Neste, and World Energy, reinforcing its capacity to support large-scale sustainable shipping initiatives.

BUSINESS

Indiabulls Housing Finance Rebrands as Sammaan Capital Limited

Indiabulls Housing Finance, a prominent Non-Banking Finance Company (NBFC), has officially rebranded as Sammaan Capital Limited. This name change follows the receipt of the Certificate of Incorporation from the Registrar of Companies (RoC) and the Certificate of Registration (CoR) as an NBFC-ICC from the Reserve Bank of India (RBI). The rebranding marks the company's 25th year of operation since its inception in 2000 as Indiabulls Financial Services Limited.

Over the years, the company has transitioned from being promoter-led to a board-run, professionally managed, and diversely-held financial institution. In a significant shift in 2020, the founding promoter stepped down as Chairman of the Board, and Mr. S. S. Mundra, former Deputy Governor of the RBI, was appointed as the Independent, Non-Executive Chairman. This change was complemented by the induction of new independent directors with extensive experience relevant to the business.

Jio Financial Services gets RBI's approval to become Core Investment Company

Jio Financial Services has obtained approval from the Reserve Bank of India (RBI) to transition from a Non-Banking Financial Company (NBFC) to a Core Investment Company (CIC). This significant milestone follows the company's application to become a CIC in November, as directed by the RBI after its demerger from Reliance Industries Ltd (RIL) and the consequent change in its shareholding pattern. The RBI's directive for the conversion to a CIC was contingent upon the approval of changes in the shareholding pattern and control of the company post-demerger. Jio Financial Services' transition to a CIC is expected to enhance its focus on investment in group companies, providing a more structured framework for managing its financial services operations and ensuring compliance with regulatory requirements.

Did You Know?

A Core Investment Company (CIC) is a type of non-banking financial company (NBFC) that primarily focuses on investments in shares of its group companies. Unlike other NBFCs, CICs do not engage in trading activities or other financial services. The primary objective of a CIC is to hold and manage stakes in group entities, ensuring a structured investment approach and compliance with regulatory standards.

Bringing a Silent Revolution through the Boardroom

Institute of Directors (IOD) is an apex national association of Corporate Directors under the India's 'Societies Registration Act XXI of 1860'. Currently it is associated with over 30,000 senior executives from Govt, PSU and Private organizations of India and abroad.

Owned by: Institute of Directors, India

Disclaimer: The opinions expressed in the articles/ stories are the personal opinions of the author. IOD/ Editor is not responsible for the accuracy, completeness, suitability, or validity of any information in those articles. The information, facts or opinions expressed in the articles/ speeches do not reflect the views of IOD/ Editor and IOD/ Editor does not assume any responsibility or liability for the same.

About Publisher

Bringing a Silent Revolution through the Boardroom

Institute of Directors (IOD) is an apex national association of Corporate Directors under the India's 'Societies Registration Act XXI of 1860'. Currently it is associated with over 30,000 senior executives from Govt, PSU and Private organizations of India and abroad.

View All BlogsMasterclass for Directors

Categories