Connect with us

Connect with us

Aug 06, 2024

Aug 06, 2024

Mitigating Climate Risks through Standardized Environmental Governance

It was in 2002 that saw the enactment of the Sarbanes- Oxley Act (SOX) as action to some of the mega failures in the corporate world. While this was in the USA, other parts of the world adopted or adapted the core aspects of SOX. What was seen then as 'difficult to implement' to 'overreaction' has pretty much become part of corporate DNA now. The focus has now moved to environment, social, and governance (ESG) and reporting by corporations on their operations and risks in these areas. Regulators in many jurisdictions have either taken actions to make ESG disclosures mandatory, at least for large businesses, or are in the process of issuing guidelines. For far too long, discussions and public discourse have focused on establishing connections between climate change and the role of humankind. We have finally turned the page to mitigating actions, and the ESG framework facilitates those.

From a governance and transparency point of view, many corporations have already been sharing voluntarily their ESG mission and performance against the target metrics. While very informative, the lack of harmonisation of the information was making it very difficult for the stakeholders to make it usable. Imagine if there were no standard or harmonization of companies' financials; we would forever be trying to understand the numbers, and it would be a task even for the finance experts.

The Securities and Exchange Commission (SEC) in the USA and the European Union (EU) have adopted new rules to enhance and standardize climate-related disclosure. Other countries like Australia, the UK, and Canada have also adopted frameworks for mandatory ESG reporting, and many others have taken up 'voluntary reporting' guidelines as a starting point. India, too, has joined this responsible movement of ESG-related reporting. Albeit focused on large companies, the downstream impact will help in spreading responsible behaviour, and over a period of time, the reporting requirement will extend to a much larger group of businesses.

To quote Gary Gensler, Chair, SEC: “Investors representing literally tens of trillions of dollars support climate-related disclosures because they recognize that climate risks can pose significant financial risks to companies, and investors need reliable information about climate risks to make informed investment decisions.”

The US and EU combined make up more than 50% of the global equity market. And once you add the influence these markets have on others, their reach is very extensive. Remember how the US-born SOX spread across the globe, albeit with some local adaptations.

Why is it relevant?

I do not profess to be an expert in climate science, but upon reading through the available data from credible institutions on the subject, it's not too difficult to see the linkages between seemingly abstract data, the commentary around it, and the visualisation of the outcome. All that is required is an open mind with inherent skepticism, which is critical for objectivity.

As far as I know, other than in blockbuster movies like Armageddon or Independence Day, there are only a few comparable events in history, like World War II and, to some extent, the more recent COVID, when the world united to fight a common adversary.

The problem is explained in the below extract from NASA on the greenhouse effect.

'In the last century, human activities, primarily from burning fossil fuels that have led to the release of carbon dioxide and other greenhouse gases into the atmosphere, have disrupted Earth's energy balance. This has led to an increase in carbon dioxide in the atmosphere and ocean. The level of carbon dioxide in Earth's atmosphere has been rising consistently for decades and traps extra heat near Earth's surface, causing temperatures to rise'

Greenhouse gas, or GHG, is any gaseous compound capable of absorbing and emitting infrared radiation, thereby allowing less heat to escape to space and trapping it in the lower atmosphere. In a sense, greenhouse gases are critical to keeping our planet at a habitable temperature. GHGs are Carbon Dioxide (CO2), Methane, Nitrous Oxide, Fluorinated gases F-gases and Ozone. Of the GHGs in the atmosphere, CO2 is approx. 75%–80%, and hence GHG is measured in CO2 equivalent, or CO2 eq.

The Intergovernmental Panel on Climate Change (IPCC) is the United Nations body for assessing the science related to climate change, and its portal is a treasure trove of related reports and findings. I have generously consumed IPCC's publications to better understand the macro risk contours and the scientific perspective. Announcements and publications following the last COP28 (UN Climate Change Conference) December 2023 meeting in Dubai are also very helpful. COP28 was seen as the first 'global stocktake' of the world's efforts to address climate change under the Paris Agreement (COP21 in 2015).

It must also be recognised that historical data prior to 1990 is patchy at best. However, the fact remains that it's the cumulative GHG at any point in time that matters. It's a complex science that is evolving as time goes by. To borrow from financial language, it's the balance sheet view that gives us a critical base line, and it's the net outcome of a period, i.e., profit and loss account, that we can effectively manage on a going forward basis to impact the balance sheet. Unlike in the commercial world, writedowns, write-offs, or restructuring are not options.

Now let's look at some of the important metrics, definitions, and concepts.

• Total global greenhouse gases, i.e., GHG emissions, in 2022 reached 53.8 Gt CO2eq (Gt = giga metric tons, i.e., 10^9 metric tons).

• The agreed limit of global warming is 1.5 degrees Celsius above the pre-industrial levels, i.e., the years 1850–1900, as the world's average surface temperature, beyond which we run the risk of irreparable damage to our planet, humankind, and all other living species. The IPCC report also finds that there is more than a 50% chance that global temperatures will surpass 1.5°C between now and 2040 before dropping. The impact on people and ecosystems is already being felt and is likely to increase in severity.

• Net Zero Emissions (NZE) by 2050 is a scenario target with a pathway whereby the amount of GHGs released into the earth's atmosphere is balanced by the amount of GHGs removed. Existing and potential carbon dioxide removal (CDR) is and will be a key lever in the net zero 50 target.

• Carbon Dioxide Removal (CDR), using the IPCC's definition, is defined as human activities removing CO2 from the atmosphere and durably storing it in geological, terrestrial, or ocean reservoirs, or in products. The IPCC documents recognise CDR as an important tool for achieving net zero emissions by 2050.

In summary, both reduced GHG emissions and increased CDR are the main drivers, and there will be as much focus and investment in newer CDR technologies as in reducing GHG. Both are integral parts of the net zero emission strategy.

Magnitude of the GHG problem

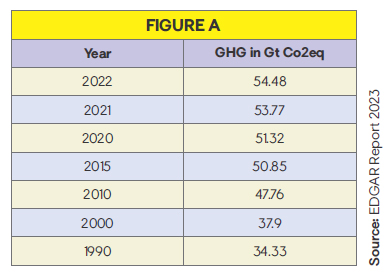

Total global GHG emissions in 2022 reached 54.48 Gt CO2eq. Figure A captures the trend since 1990. The annual average increase in emissions has been 0.56 Gt CO2eq per-year since 2010, while in the prior decades it was 0.98 Gt CO2eq per year in 2000–2010 and 0.35 Gt CO2eq in 1990–2000.

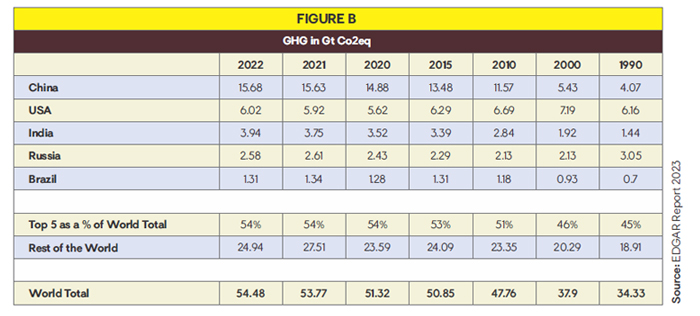

That the economic activities have influenced GHG emissions is not a surprise. USA and China rank top two in the world's Gross Domestic Product (GDP) ranking, while India, Russia and Brazil are within the top 10. Figure B gives a snapshot of countries with top 5 GHG emissions in the world. As is evident the top 5 countries contribute more than 50% of the world's GHG. It's worthwhile noting though Greenhouse gas emissions contribute to global environmental harm no matter where they originate.

Moving manufacturing from one country to another will only move the emissions to a new place. It is clear that the present technologies in use and lifestyle need to change if we are to reduce GHG in the coming years. Economic activities, population and prosperity are expected to increase, and the above emissions would have to be reduced aggressively for us to get to net zero situation. Getting to Net zero at a global level is the ultimate objective. Speaking of the obvious, there is no state, nation or regional border when it comes to GHG emission. Of course, the transition will vary from economy to economy while we pursue the target of aggregate outcome.

A sectoral (by industry) split is a more helpful view. It should not be a surprise that the Energy related (Power + Industrial Combustion + Transport) sector accounts for 67% of the world's emissions in the year 2022.

Irrespective of how innovative we can be in introducing scaled-up CRD tools, we will still need the GHG emissions to decline before 2030 to achieve net zero by 2050 and contain global warming to 1.5˚C. A deeper dive into each sector will bring out how inter-related these sectors are. However, that is neither the purpose of this article, nor do I have the extensive expertise to do justice.

Substituting the currently predominant energy sources, such as coal and oil, with GHG-friendly alternatives can significantly advance our quest for net zero. The share of solar and other renewables in global electricity generation is already close to 30%. New-generation alternatives like biofuel from algae (third generation biofuel) and hydrogen as a source of clean energy are being explored. Though the new generation and step-up technologies are very impactful, they take time to be perfected and commercialized. Investment and risk-taking are both required in large magnitude for those, and it's often a hit or miss over the 'planned' time horizon. Additionally, once realized, the transition to these newer sources of energy will require a redesign of most of the equipment or machines that use 'energy' to operate.

Until then, it is on us to take up optimisation of current products and offerings – be it smart grid to optimise demand and supply/generation of electricity to products optimised for sustainability as low hanging fruits in the shorter time horizon. And, while these may be seen as relatively less dramatic, its combined effect when factored for the total human population of 8 billion would be very significant. This has a universal appeal and resonates well even with the industries that have traditionally been high- emitters or hard-to-abate (decarbonise) sectors. Add to this, changes in lifestyle choices, and these together will keep the needle moving in the right direction.

The balance sheet challenge

Taking 55 Gt CO2 eq as the current annual gross GHG, as I understand from reading various papers, approx. 18 Gt is soaked naturally by earth into the ocean, soils, and natural sinks (source: Climate Portal MIT), and today's available CDR tools capture a small fraction, around 2 Gt annually. That leaves approx. 35 gt CO2 eq at today's run-rate as an adder to the atmosphere. If a balance sheet were to be drawn up, this is the number that will add to the carried forward GHG balance. It's also worth noting that with rapid urbanization, the natural absorption of carbon is under stress, adding another risk to the carbon balance sheet.

Both reduced GHG emissions and increased CDR are the main drivers, and there will be as much focus and investment in newer CDR technologies as in reducing GHG. Both are an integral part of the net zero emission strategy.

The historical data is indicative and uses current knowledge. The IPCC itself was established in 1988, though I am sure work in this space precedes this date. While not accurate, it will be fair to rely on backward extrapolation, and that indicates humankind has been a 'noticeable' net GHG adder, at least since 1950.

Sustainable ways of doing things are not cheaper, and understandably so. Traditional products have undergone generations of evolution and re-engineering. These have been well optimised from a cost point of view. Therefore, substitution of traditional products by 'green' products faces a natural headwind. Altering market forces and translating expressions of preference to buy commitments is a challenge. To induce scale, there must be a different approach. 'Market Design' is more important than ever. While the 'free' market evolves organically, it can also be 'designed' for greater good and speed; consumers, producers, regulators, and business leaders, all need to get involved.

On the one hand, we will need to reduce GHG emissions, and at the same time, we will need to find new ways to substantially increase CDR. Needless to say, the world population is increasing, and with growth in per capita income, it is only expected that consumption will be on the rise. And that brings another element to our global effort, and that is lifestyle changes.

A December 2023 article by McKinsey titled 'Carbon Removal: How to Scale a New Gigs-to-Industry' puts the CDR development industry requiring $6 trillion to $16 trillion of cumulative investment by 2050 to deliver carbon removal capacities for net zero. Of course, how the CDR offerings play out in the market as a service is unknown now, but a model will develop as investments are committed.

Role of the board and governance through ESG

Newer areas of product sustainability, design for repairability and reusability, and investment in sustainable technologies will (necessarily) become prime topics for consideration in addition to the old chestnut topics that a functional board is well versed in. The new governance model is here to stay, and this will entail looking through the prism of risk management and engagement with multiple stakeholders while delivering on the traditional objective of fiduciary outcome over a longer-term time horizon.

One cannot but stress that as an integral part of governance, companies must device their GHG/Carbon budget as a starting point. If something is not measurable, it's difficult to manage.

One cannot help but stress that, as an integral part of governance, companies must use their GHG/carbon budget as a starting point. If something is not measurable, it's difficult to manage. If the primacy of the market is to be believed, it's critical to note that:

• Investors and other stakeholders will gravitate toward 'environment' as a thematic core for engagement. It can even lead to exclusion from a market. After all, most businesses are part of somebody else's value chain.

• Newer regulations will follow. Not to ignore the fact that net zero by 2050 is a global pursuit and not a 'nice to do'. Regulations have always been a few steps behind market events, and it would be unreasonable for us to assume new regulations will be in place for businesses to comply with. The board's role in advocacy and representations using ESG as the platform will have to play a pivotal role

• ESG reporting and disclosures are gradually becoming mandatory across the globe.

• The direct cost of not having a carbon or GHG budget or being unprepared will be costly. There are enough private funds and capitals in the world—a large enough pool to normalise the use of 'Sustainability' on an equal footing as 'credit worthiness' and 'profitability' for pricing purposes. It will have a domino effect.

• Resource and budget allocation will be a difficult call and will require choice from a wider buffet of options. The 'Risk and Reward' assessment will follow a different script. It's fair to say that there will be no easy choice of 'whether' sustainable or not, but 'how' sustainable.

Moving manufacturing from one country to another will only move the emissions to a new place. Greenhouse gas emissions contribute to global environmental harm no matter where they originate.

He is a senior executive with 35 years experience in multinational companies, and most recently as Chief Financial Officer- Asia Pacific Region & Regional Board member of Landis + Gyr Group. He has served as a board member in India, Australia, and other countries. Currently based in Sydney, Australia, he is a Chartered Accountant, Fellow of IOD, India and a member of the Australian Institute of Company Directors.

Owned by: Institute of Directors, India

Disclaimer: The opinions expressed in the articles/ stories are the personal opinions of the author. IOD/ Editor is not responsible for the accuracy, completeness, suitability, or validity of any information in those articles. The information, facts or opinions expressed in the articles/ speeches do not reflect the views of IOD/ Editor and IOD/ Editor does not assume any responsibility or liability for the same.

About Publisher

Bringing a Silent Revolution through the Boardroom

Institute of Directors (IOD) is an apex national association of Corporate Directors under the India's 'Societies Registration Act XXI of 1860'. Currently it is associated with over 30,000 senior executives from Govt, PSU and Private organizations of India and abroad.

View All BlogsMasterclass for Directors

Categories