Connect with us

Connect with us

Jun 06, 2022

Jun 06, 2022

Over the years, the occurrence of large scale corporate frauds in India has nudged organisations to relook at and strengthen (in some cases overhaul) their corporate governance framework. These incidents have also resulted in a series of legislative and regulatory requirements in dealing with and reporting corporate fraud.

Further, the business disruption caused by the pandemic has underscored the need to be vigilant and strengthen governance frameworks. Historically, data shows business disruptions tend to be followed by a rise in the discovery of fraudulent practices as well as new types of fraud risk vulnerabilities. Given the current economic climate, it is likely that some organisations may inadvertently choose to focus on sustaining operations, improving growth and profitability while placing compliance on the back burner.

Today, regulatory requirements place the accountability of effective fraud risk management on the Board/ Senior management. Coupled with the growing focus on ethics and current dynamic business environment, this has also increased the importance of the role of Independent Directors (IDs) in being effective deterrents to fraud, mismanagement, and lapses in corporate governance. As per Deloitte India and Institute of Directors (IOD) latest joint survey report titled “Corporate fraud and misconduct: Role of Independent Directors”, approximately 63 percent (of IDs) feel that that the current business environment induced by the pandemic can spur fraud over the next two years.

Some of the interesting observations include:

(1.) Largescale remote working (21.79 percent) and cash flow crunch leading to business operations taking a priority over compliance (20.09 percent), were identified as the key factors for the expected rise in frauds.

What do you feel are some of the factors/pressures that can contribute to frauds in the future?

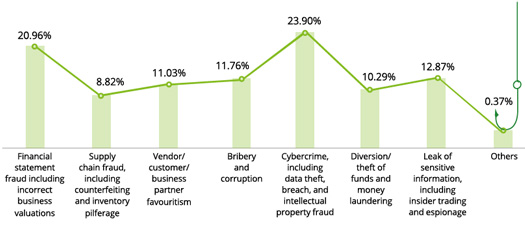

(2.) Cybercrimes (23.90 percent), financial statement frauds (20.96 percent) and leakage of sensitive information including insider trading (12.87 percent) are most likely frauds to be experienced in the near future.

From the list below, identify the top three frauds and malpractices that you believe can expose the company to significant monetary, regulatory, and reputational loss.

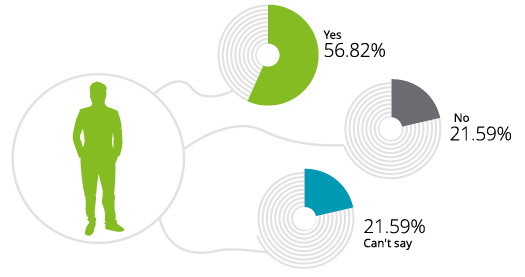

While around 57 percent IDs indicated that their board had established an effective Fraud Risk Management (FRM) framework, around 22 percent IDs indicated the need to increase awareness amongst employees on ethics, integrity, and reporting fraud or misconduct issues to improve the FRM framework.

Has the Audit Committee of your board established and effective anti fraud (including Financial Statement Frauds) and misconduct detection mechanism?

Given the long term impact of the current business disruption, what are the best practices that organisations can focus on to improve their fraud risk management practices? (Please select top three)

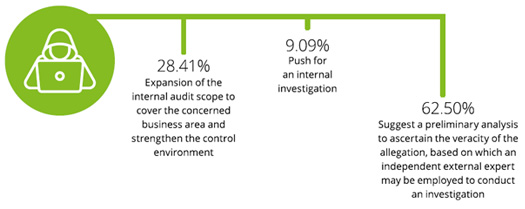

(3.) After receiving suspicious activity reports, around 63 percent IDs responded that they would suggest a preliminary analysis to ascertain the veracity of the allegation and may consider the appointment of an independent expert to conduct an investigation.

What would you typically suggest upon receiving suspicious activity reports?

Fraud risk management is a dynamic phenomenon as the environment, be it internal or external, is constantly evolving. While the large organizations have generally set up fraud risk management frameworks relevant in their context, however the changed environment could have challenged the efficacy of existing frameworks both from a design and implementation perspective. A structured approach to fraud risk management will help the ones charged with ensuring corporate governance to think in the right direction and ask the right questions. A robust fraud risk management program addressing the requirements of people, process and technology improvements is the need of the hour.

Approximately, 75 percent (of IDs) agreed that they could play a significant role in preventing, detecting and responding to fraud. This is quite encouraging as there is growing realisation within the community to strengthen fraud risk management. However, close to 54 percent (of IDs) expressed their need to be better equipped to fulfil their fiduciary responsibilities.

Do you believe independent directors can play a significant role in preventing, detecting and responding to fraud?

Do you believe you are well equipped to discharge your regulatory and fiduciary responsibilities towards fraud prevention and detection? (Select one option in the appropriate category)

According to a majority of the IDs who responded to the survey, specific training on fraud risk management, understanding the organisation's fraud risk profile, independent screening of highrisk areas and increased visibility on the review and continuous monitoring mechanisms (put in place by the organisations for timely detection of unusual activities) will empower them to discharge their responsibilities better.

IDs can help in building a robust fraud monitoring mechanism (within an organisation) by promoting the adoption of latest technologies to address corporate fraud. Given the current scale and magnitude of business transactions, technology is not only a key enabler from an operational perspective but can be a great differentiator to proactively manage (predict/ prevent/detect/respond) the potential risk of fraud. This can be facilitated through an array of tools and a combination of data analytics, artificial intelligence, and machine learning. In addition, the new remote working environment has also helped elevate the role of technology to protect the business both from intentional misdeeds and unintentional errors.

Further, technology can help organisations with their fraud reporting obligations to regulatory bodies or to seek legal recourse. In our view, the rapid adoption of new age technologies/tools has also resulted in generating complex and voluminous organisational data which can lead to difficulties in discovering relevant sets of information and actionable insights.

Although there are multiple priorities for IDs, in our view, there is a need for IDs to push senior management to enhance the organisation's anti fraud controls framework and continuous monitoring efforts. At the end of the day, these should be integrated within the organisation's corporate governance framework to help safeguard the interests of all stakeholders and fulfilling their fiduciary responsibility.

He is a Partner and Head of the Deloitte Forensic practice in India. He holds over two decades of professional experience of which he has spent over ten years advising varied clients including corporates, financial institutions, hedge funds and private equity funds on a wide range of Forensic services.

Owned by: Institute of Directors, India

Disclaimer: The opinions expressed in the articles/ stories are the personal opinions of the author. IOD/ Editor is not responsible for the accuracy, completeness, suitability, or validity of any information in those articles. The information, facts or opinions expressed in the articles/ speeches do not reflect the views of IOD/ Editor and IOD/ Editor does not assume any responsibility or liability for the same.

About Publisher

Bringing a Silent Revolution through the Boardroom

Institute of Directors (IOD) is an apex national association of Corporate Directors under the India's 'Societies Registration Act XXI of 1860'. Currently it is associated with over 30,000 senior executives from Govt, PSU and Private organizations of India and abroad.

View All BlogsMasterclass for Directors

Categories