A Report on Staying Vigilant: Due Diligence for Independent Directors

The Institute of Directors (IOD), India, organised the first Global Webinar of the Boardroom Webinar Series 2024. The theme was “Staying Vigilant: Due Diligence for Independent Directors”. The webinar was attended by around 400 participants, comprising Independent Directors, Regulators, aspiring and serving Board members, directors, policy-makers, educationalists, and private as well as public sector institutions

The 'Welcome Address' was delivered by:

Lt. Gen. Surinder Nath, PVSM, AVSM (Retd.)

President, Institute of Directors

former Chairman, Union Public Service Commission

former Vice Chief of Indian Army

former Independent Director, Larsen & Toubro

Lt. Gen. Nath welcomed everyone to the webinar and shared that the Institute of Directors, India, has celebrated 34 years of promoting corporate governance excellence since its inception in 1990. He highlighted how the webinar theme truly aligns with IOD's principles and stressed the importance of due diligence for Independent Directors. He emphasized the need for Independent Directors to proactively assess risks, evaluate strategies, maintain ethical standards, and ask the right questions in boards. He added that Independent Directors need to be stewards of corporate integrity, and must continuously educate themselves, stay abreast of the latest developments, and adapt practices to meet the evolving demands of their roles.

The 'Guest of Honour Address' was delivered by:

Mr. G. Mahalingam

Independent Director on Multiple Boards

(LIC, DSP Pension Fund Managers, Care Ratings, CDSL, IIBX,IL&FS, City Union Bank, et al.)

former Whole-Time Member Securities & Exchange Board of India (SEBI)

Mr. Mahalingam spoke on the theme, “Understanding the Legal and Regulatory Landscape: Key Considerations for Independent Directors.” He began by noting that being an independent director is a challenging role that requires a careful balance between safeguarding the interests of the promoter and those of minority shareholders. He advised independent directors to provide constructive challenges to the management. He stated, “Being a director means examining all sides of a strategic proposal. An independent director is not just a member of a board; he is like an umpire in a sports match or a judge of the management's ethical conduct.” He emphasized the importance of focusing on technology, noting that since few people fully understand technology, technology budgets often pass through with little scrutiny. Therefore, independent directors must ask relevant questions about technology. Mr. Mahalingam shared five expectations from SEBI that serve as principles for independent directors:

1. Strive to attend all board meetings.

2. Voice concerns sternly and assertively, and ensure that issues are reported.

3. Apply thorough due diligence in scrutinizing financial statements and maintain strong oversight of disclosures.

4. Take an active role in formulating strategies.

5. Be vigilant about the flow of information to the board, ensuring that it is timely, adequate, and accurate.

The 'Keynote Address' was delivered by:

Dr. Ashish Makhija

Managing Attorney at AMC Law Firm

World Bank-Trained Corporate Trainer

Dr. Makhija's spoke on the theme, 'The top 5 things to consider while joining a Board today, as an Independent Director'. He emphasizing on the significant responsibility and accountability that comes with being an Independent Director. He outlined five crucial factors using the acronym "A Trustworthy Leader Balances Risk":

A: Alignment with Personal and Professional

T: Time Commitment

L: Legal Duties and Responsibilities, including duties of care, financial oversight, and acting in the best interest of the

B: Board Dynamics and Culture, covering internal communication and leadership style

R: Risk and Liabilities, encompassing awareness of risks such as reputational damage and regulatory noncompliance.

Dr. Makhija also highlighted Section 447 of the Companies Act, 2013 which defines fraud as any act or omission, including misrepresentation, by a director or any other person, involving fraud or willful concealment of material facts with the intent to deceive and prejudice the interests of the company, its shareholders, or creditors, and stressed the importance of directors being vigilant against fraudulent activities.

PANEL SESSION: THE DUE DILIGENCE CHECKLIST FOR INDEPENDENT DIRECTORS

The Session was chaired by:

Dr. Ashish Makhija

Managing Attorney at AMC Law Firm

World Bank-Trained Corporate Trainer

The distinguished speakers of the Panel were:

1. Mr. S. Santhanakrishnan

Senior Managing Partner

PKF Sridhar & Santhanam LLP

Independent Director on Multiple Boards (ICICI Home Finance, PKF Proserv, et al.)

2. Ms. Vijaya Sampath

Independent Director on Multiple Boards (Mankind Pharma, Varroc Engineering, Craftsman Automation Safari Industries, et al.)

3. Mr. Ch. S. S. Mallikarjunarao

Independent Director

Axis Bank Limited, Mumbai

4. Ms. Sushmita Ghatak

Independent Director, Anudip Foundation

Strategic Advisor – ESG & Sustainability, Athena Infonomics

former MD & CEO, ICRA Analytics Ltd.

Mr. Santhanakrishnan discussed the challenges faced by Independent Directors and offered strategies for maintaining vigilance. He emphasized that a key issue in boardrooms is the disorganization of agendas. To address this, he recommended that Independent Directors conduct an ABC analysis to ensure thorough oversight of related party transactions, including requiring the related party to certify that transactions comply with regulations.

He also highlighted the importance of scrutinizing cash flow statements as a crucial method of staying vigilant. Mr. Santana Krishna advised that Independent Directors do not need to have all the answers but should focus on asking the right questions. He acknowledged that presenting opposing views in meetings can be challenging but suggested using email as a simple and effective way to communicate concerns. He clarified that the role of an Independent Director is not to alter decisionmaking but to present relevant facts and perspectives. He concluded by emphasizing that one person can indeed make a difference.

Ms. Sampath outlined essential principles for independent directors both before and after joining a board. Before joining, independent directors should investigate:

• The sector in which company operates and its competitors.

• The reasons for their potential appointment and meet with the existing board members.

• The nature of the executive directors—whether they are professionals or related/indirect parties.

• The organization's power structure.

• The other independent directors on the board.

She highlighted red flags to watch for after joining a Board:

• Issues in financial reporting.

• Frequent changes in audit, CFO, internal auditors, or other key positions.

• Persistent negative cash flow.

• Frequent investments in subsidiaries.

• Significant variances in financial ratios, including high dividend payout ratios, and large discrepancies in gross margin, operating margin, net margin, current ratios, and equity ratios.

Mr. Mallikarjunarao emphasized the importance of understanding the regulatory perspective on a company's functioning, noting that different sectors are overseen by various bodies, such as SEBI for general companies and the RBI for banks. Before accepting a role as an Independent Director, it is crucial to research the company's sector and competitors, understand why the board is interested in you, meet with current and former directors, evaluate the executive directors and the power structure, and review the company's financial reports and governance practices. During the tenure, Independent Directors should ensure that agendas are well-organised and comprehensive, scrutinize financial statements carefully, be proactive in questioning and seeking clarification, and utilize public domain resources for additional information. Effective governance requires a clear understanding of the company's charter and committee structures, a commitment of time and effort, and ensuring clarity and completeness in agendas and financial summaries. It is also essential to actively address and rectify any regulatory observations. The key takeaway is to apply a "Know Your Company" approach, akin to the "Know Your Customer" (KYC) principle in banking, emphasizing the need for thorough research and ongoing diligence in the role.

Ms. Ghatak spoke about the importance of due diligence for independent directors before joining, during their tenure, and after leaving a board. She emphasized the need to scrutinize financials, advising directors to consider credit ratings alongside ESG ratings. She also highlighted the value of BRSR reports as a significant source of information for independent directors. Ms. Ghatak urged directors to check for promoter pledges and adverse news in the media. While serving on a board, she recommended that independent directors study visible policies and examine relevant cases. She noted that SEBI expects independent directors on the audit committee to be financially literate and those on the CSR committee to review impact assessment reports and examine the usage of CSR funds. Upon leaving a board, she stressed the importance of ensuring that necessary DIR forms have been filed.

The panel session as followed by an interactive Q&A session with the participants.

POLL

Following this, a poll consisting of two questions was conducted to gather participants' views on key issues. It received an over whelmingly active response, demonstrating the participants' keen interest and willingness to contribute. This engagement enriched the discussions with diverse perspectives and valuable insights.

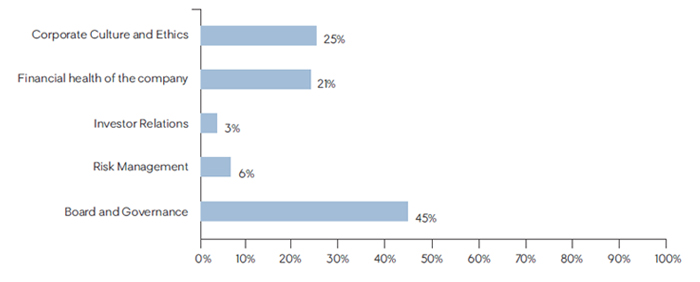

Question 1: What is the most crucial aspects of Due Diligence when accepting an ID position.

The analysis indicates that 'Board and Governance' is the top due diligence priority for ID positions. This was followed by factors including 'Corporate Culture and Ethics' and 'Financial Health of the Company'. Risk Management and Investor Relations were considered the least during the due diligence process by IDs.

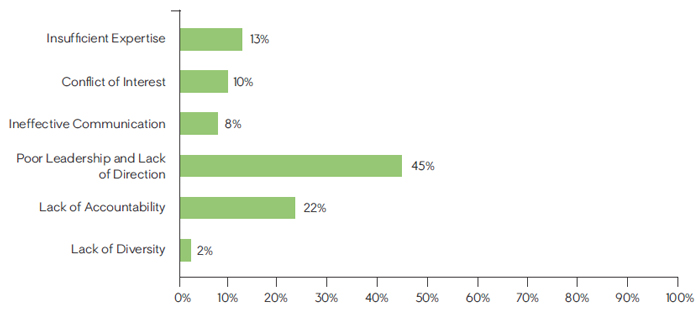

Question 2: Why do Boards fail?

The results indicate that boards fail primarily due to 'Poor Leadership and Lack of Direction', followed by 'Lack of Accountability'. Other factors include Insufficient Expertise, Conflict of Interest, and Ineffective Communication. Lack of Diversity is the least significant, at 2%.

SPECIAL TALK: EMOTIONAL QUOTIENT OF ID’s

This was followed by a 'Special Talk', delivered by:

Ms. Julie Lewis

Professional Speaker, Author & Explorer

Ms. Lewis began her talk with the quote, "Stand like a mountain, flow like water," by Lao Tzu. She mentioned her favorite philosopher, Socrates, who said, "Know thyself," extending this to knowing one's emotions, values, strengths, and also, 'Knowing thy Boards'. She introduced her recent book, "Uncharted Waters," which delves into the element of water and its connection to emotions. She explained that water can be calm and soothing or destructive and turbulent. The book draws parallels between physical, spiritual, and emotional intelligence and the element of water. She further described the concept of "blue minds", which refers to a state of calm, meditative focus, and clear thinking experienced when near water. She concluded by emphasizing the importance of being like water for emotional flexibility and fitness, reminding the audience, "You are water, and water always finds a way."

This was followed by the 'Vote of Thanks' proposed by:

Mr. Manoj K. Raut

CEO and Secretary General - Institute of Directors

Mr. Raut thanked all the participants for their commitment and engagement in the discussions. On behalf of IOD, he extended his gratitude to all the speakers and panelists for sparing their valuable time. He concluded the deliberations by stating, "Today's discussions highlight the complex and crucial role of independent directors. The insights shared emphasized the need for directors to be vigilant, proactive, and confident in their roles, bringing a fresh, unbiased perspective to the boardroom. This journey requires continuous learning, adaptation, and a commitment to excellence and integrity, balancing governance demands with independence."

IOD is grateful to the partners of the 2024 Boardroom Webinar series:

Our Institutional Partners:

1. Gujarat Fluorochemicals Limited.

2. Bitscore Cybertech LLP

Our Strategic Partner: Nasdaq

Our Knowledge Partner: Taxmann

This report is compiled by:

Ms. Laghima Sharma

Assistant Executive Editor

Author

Institute of Directors India

Bringing a Silent Revolution through the Boardroom

Institute of Directors (IOD) is an apex national association of Corporate Directors under the India's 'Societies Registration Act XXI of 1860'. Currently it is associated with over 31,000 senior executives from Govt, PSU and Private organizations of India and abroad.

Owned by: Institute of Directors, India

Disclaimer: The opinions expressed in the articles/ stories are the personal opinions of the author. IOD/ Editor is not responsible for the accuracy, completeness, suitability, or validity of any information in those articles. The information, facts or opinions expressed in the articles/ speeches do not reflect the views of IOD/ Editor and IOD/ Editor does not assume any responsibility or liability for the same.

Quick Links

Quick Links

Connect us

Connect us

Back to Home

Back to Home